Wringing Out the Risk – Maine Real Estate

If we believe “what goes up, must come down” then it stands to reason that the inverse should also be true. Although one has to think gravitational pull makes the former apply to many more circumstances, it seems to be the case with the widespread recovery in many of the most economically sensitive assets. When it comes to US and Global economic conditions, we have weathered a historic downdraft which is working back to a more healthy equilibrium. Evidence abounds when looking at several indicators that the fear of economic collapse has subsided. Interest rates have moved significantly higher in recent weeks into a backdrop of increasing consumer confidence, lower Gold prices, and higher oil and gasoline prices. Each of the above are classic signals the market is expecting ongoing improvements and is now joined by the Federal Reserve readying to pull back the throttle on its stimulative economic levers.

The National real estate statistics have been very strong in recent months with double digit gains in both Unit Volume and Median Sale Price for single family homes. The Northeast Region has posted comparable Unit Volume increases but somewhat weaker prices by comparison. The Maine economy and real estate market are very closely tied to general economic conditions in the Northeast and, to a lesser extent, national economic conditions. Our second home buyers and sellers from out of state are most often coming to/from primary residences in Massachusetts, New York and Connecticut.

The Maine real estate market has been improving steadily for more than 2-years. While the improvement is not uniform in terms of sales volume, prices and all geographic locations, the evidence is clear we are well along the path to a significant recovery. It is also important to note that Maine had a very strong 2012 recovery which can create misleading results when only looking at year over year numbers. For example, there were 1,334 single family homes sold in June in Maine, this represented a 6 ½% improvement versus last year, however when looking at the 2-year performance we find sales have grown 32% since June 2011. In fact, we are back to 2007 sales volume numbers, but still well shy of the 2006 peak.

Home sale price movements tend to lag changes in the demand for homes as measured by unit sales volume. Maine just reported a June median Sale Price of $184,000. While median sales prices can be somewhat volatile given the relatively small market in which we operate, our current report is consistent with the increasing price environment in June 2004 and again in 2008 on the way back down. The highest reported median home sale price was $202,280 in April of 2007, which is only about 10% below the current release.

Chart courtesy of Yahoo Finance

Interest Rates – It was just about a year ago that the 10-year US Treasury note was yielding 1.40%; it now yields more than 2.60%. It comes as no surprise that the 30-year Conventional Mortgage rates have climbed a commensurate amount. Gold, another classic safe haven asset has declined 17 % in the past year and more than 25% from its historic highs confirming the markets belief that we are in more calm economic waters. The sudden rise in interest rates seems to have again brought some of the more tentative buyers off the sidelines to take advantage of the very attractive mortgage interest rates while they are still available. I have heard some voice concern that significantly higher rates can/will hurt the housing recovery. While we all know this to be true in an absolute sense, the current rate environment is so very attractive that we should be able to sustain a substantially higher rate environment with little or no impact on housing recovery. It was not very long ago when 6% 30-year fixed rate mortgage seemed very attractive.

We remain confident with respect to the Maine Real Estate Market that the recovery will continue on track with a steady healthy improvement in both unit sales volume and median sale prices! And while not scientifically accurate, “what goes down, will go up!”

Maine Listings is the source of data, its accuracy cannot be guaranteed.

Legacy’s Legacy: “Giving Back to Maine”

Legacy’s Legacy is an agent funded charitable group within our company. We are very pleased to have nearly 100% of our agents contribute a donation from each and every closing. Their generosity has allowed us to sponsor 3 significant events this year already. We sponsored Share Our Strength’s “Taste of the Nation” Event at Wolf Neck Farm in Freeport in June. The proceeds from this fantastic culinary event are exclusively dedicated to feeding hungry children in Maine. For the 3rd consecutive year, we are “Strength Sponsors” for the Maine Cancer Foundation’s “Tri for a Cure” women’s Triathlon. There were more than 1,000 participants registered to participate in the extraordinarily impressive athletic and fundraising event. And a special thanks to our agents who volunteered to work the event as well!

This year marks the beginning of a new and developing relationship with Habitat for Humanity as well. Thanks to the support of our clients and our continued growth, we have added this globally recognized non-profit organization to our list. Habitat and its housing mission is a great fit for Legacy Properties Sotheby’s International Realty. We recently hosted an event in Southwest Harbor highlighting Habitat for Humanity and their many initiatives in Maine. Steve Thomas, former host of “This Old House” and “Renovation Nation” was our guest speaker and Master of Ceremonies. Needless to say, a good time was had by all!

Legacy Properties Sotheby’s International Realty

Opens Damariscotta Office

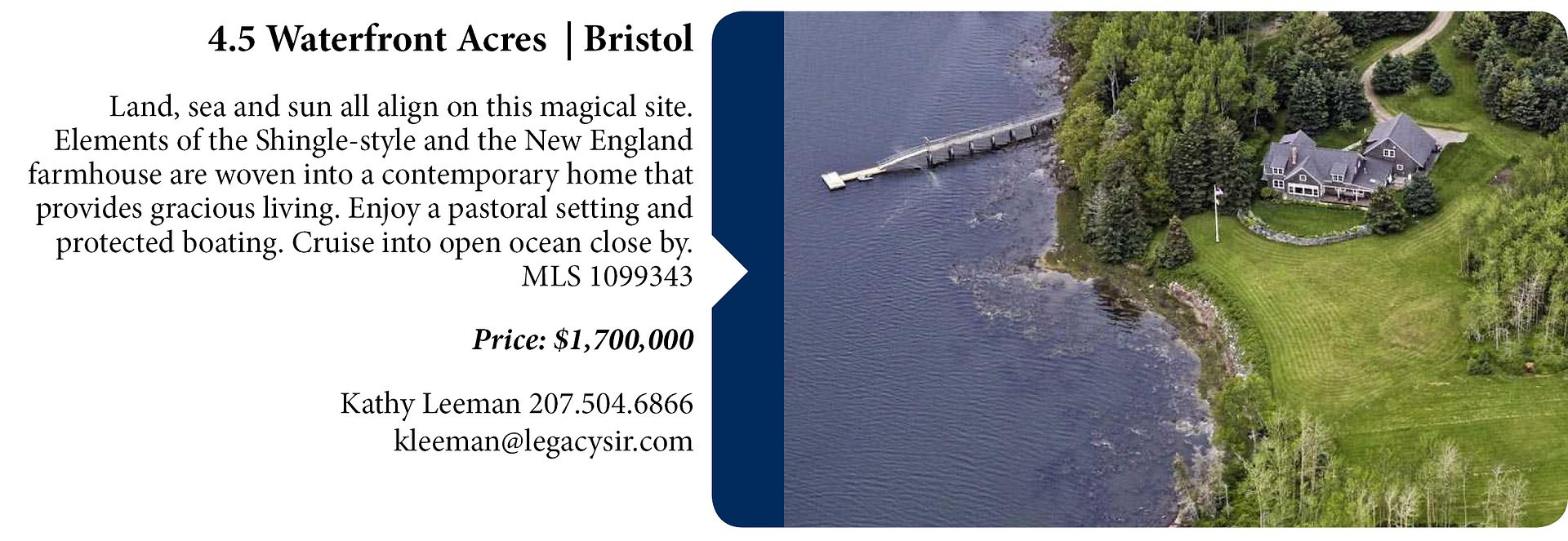

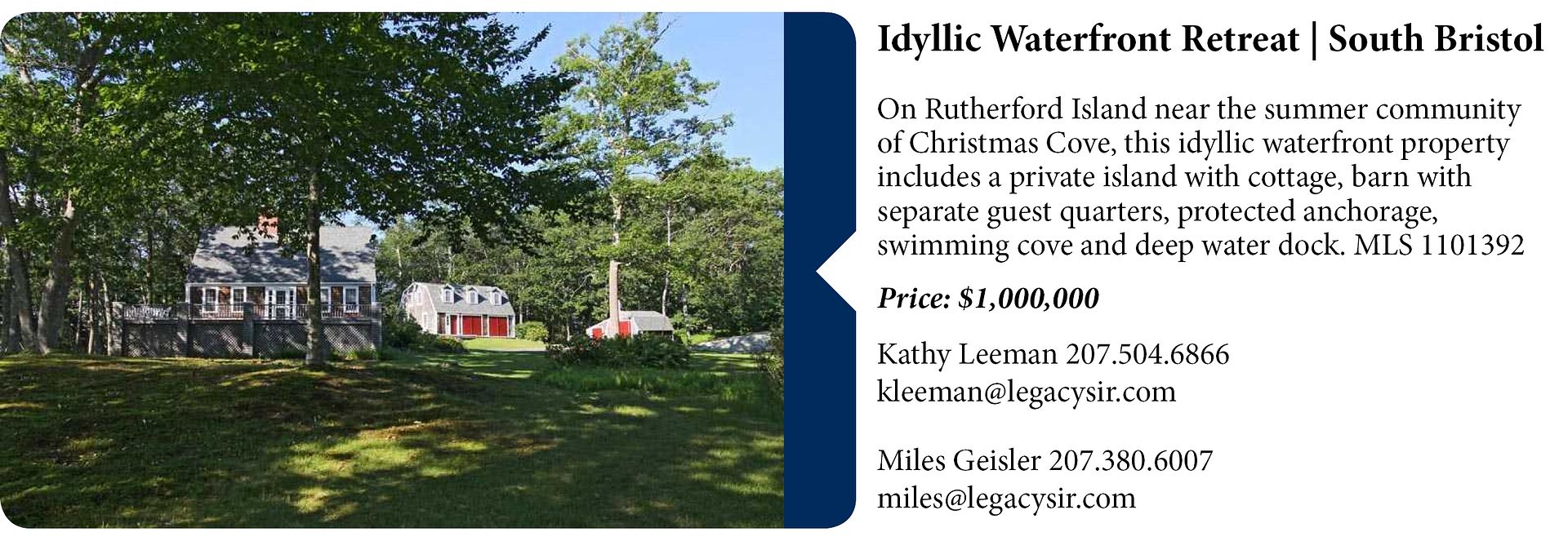

We are pleased to announce we have opened a new office at 170 Main Street in Damariscotta. We are already up and running with 5 full-time agents on site. The welcome has been overwhelming and very exciting as we extend the Sotheby’s International Realty brand into this beautiful territory for Maine real estate. This location will provide us better access to Bristol, South Bristol, Christmas Cove, Round Pond, Damariscotta Lake, Bremen and the Boothbay Peninsula.

Please join me in welcoming our agents to our latest venture.

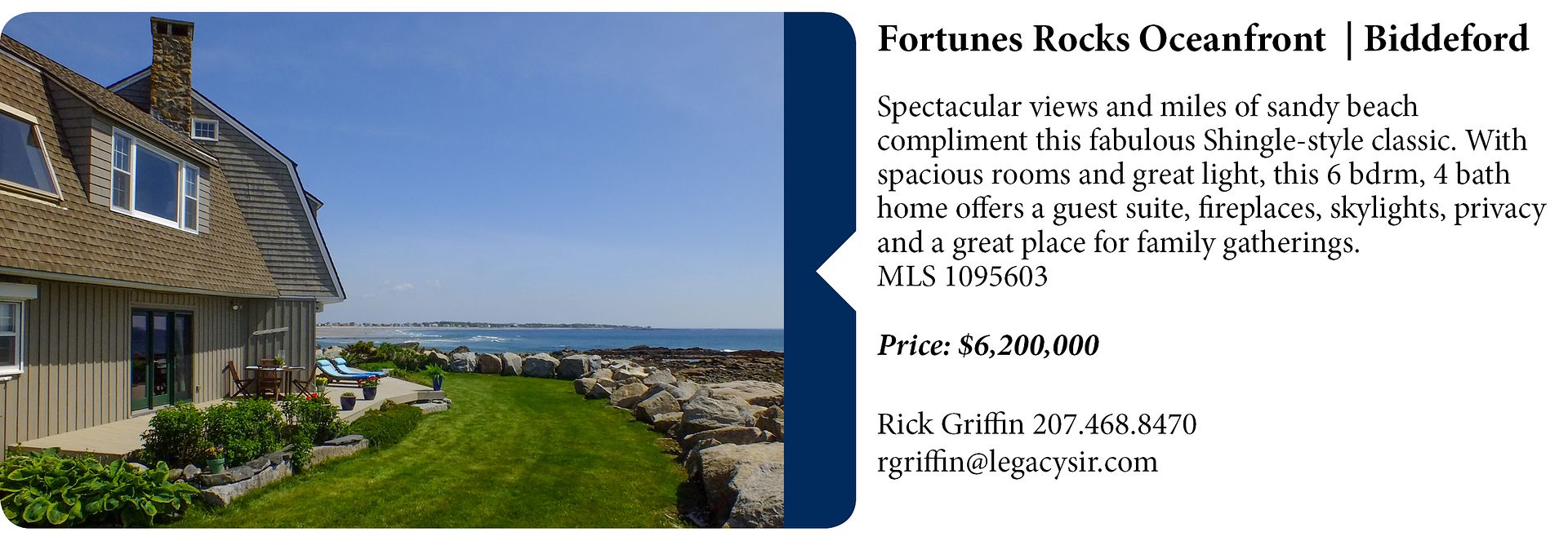

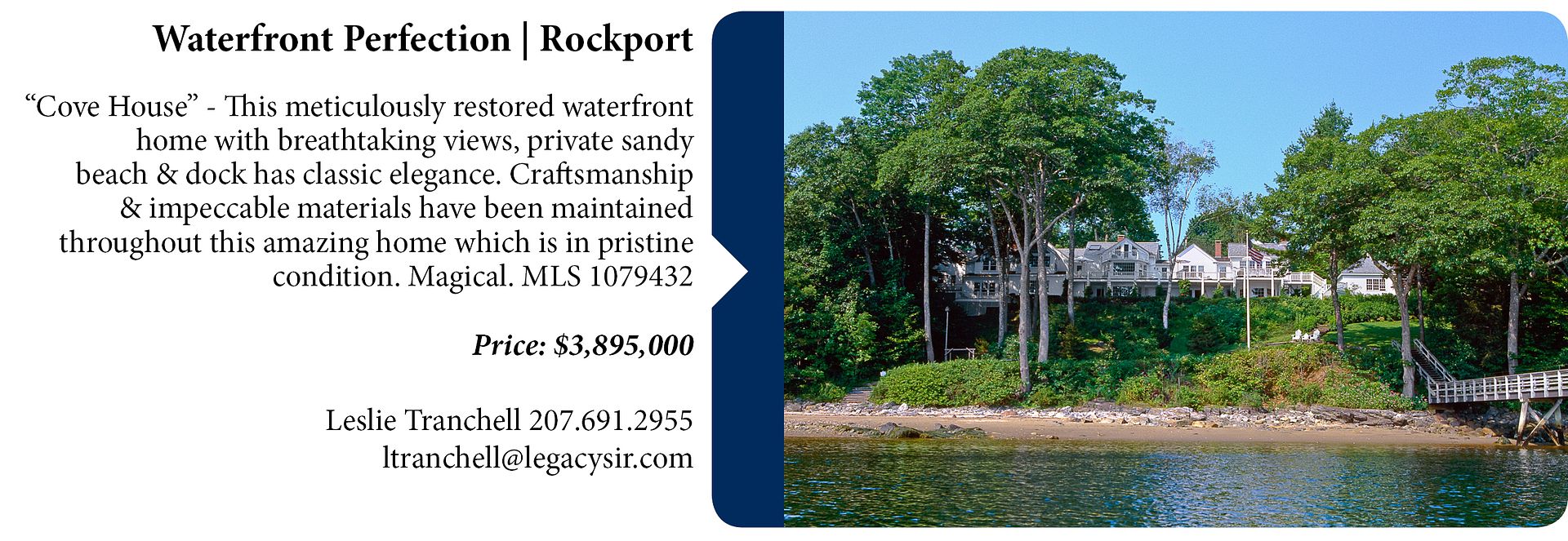

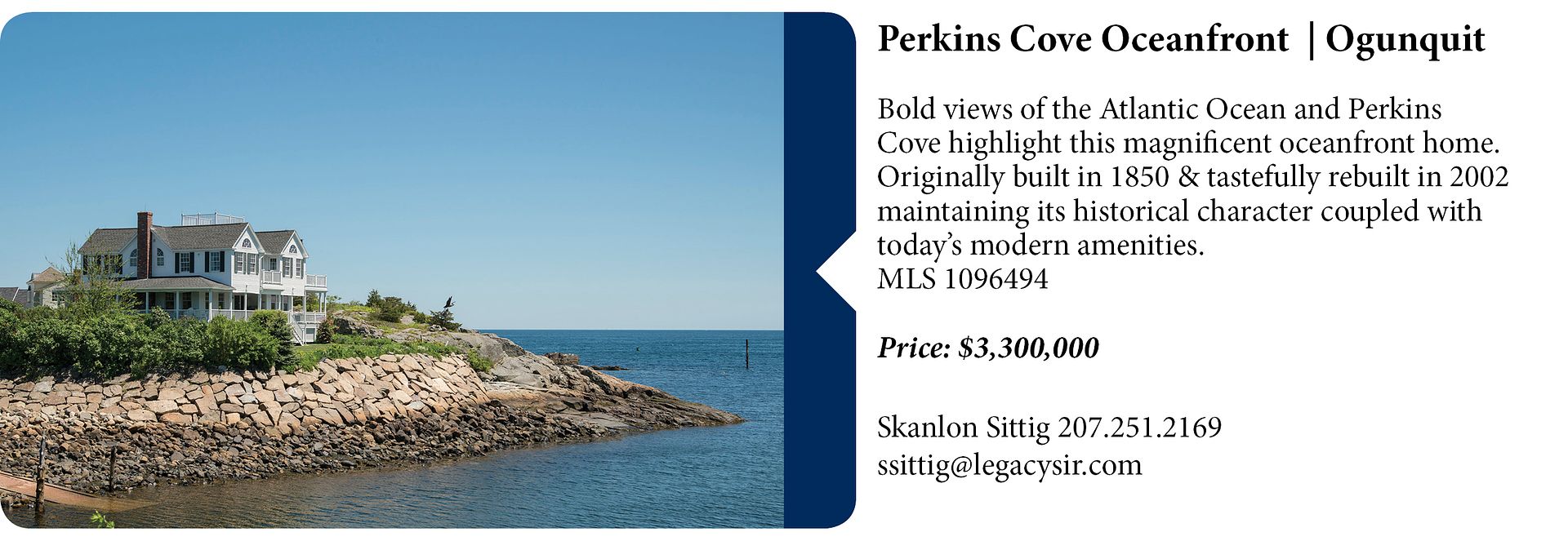

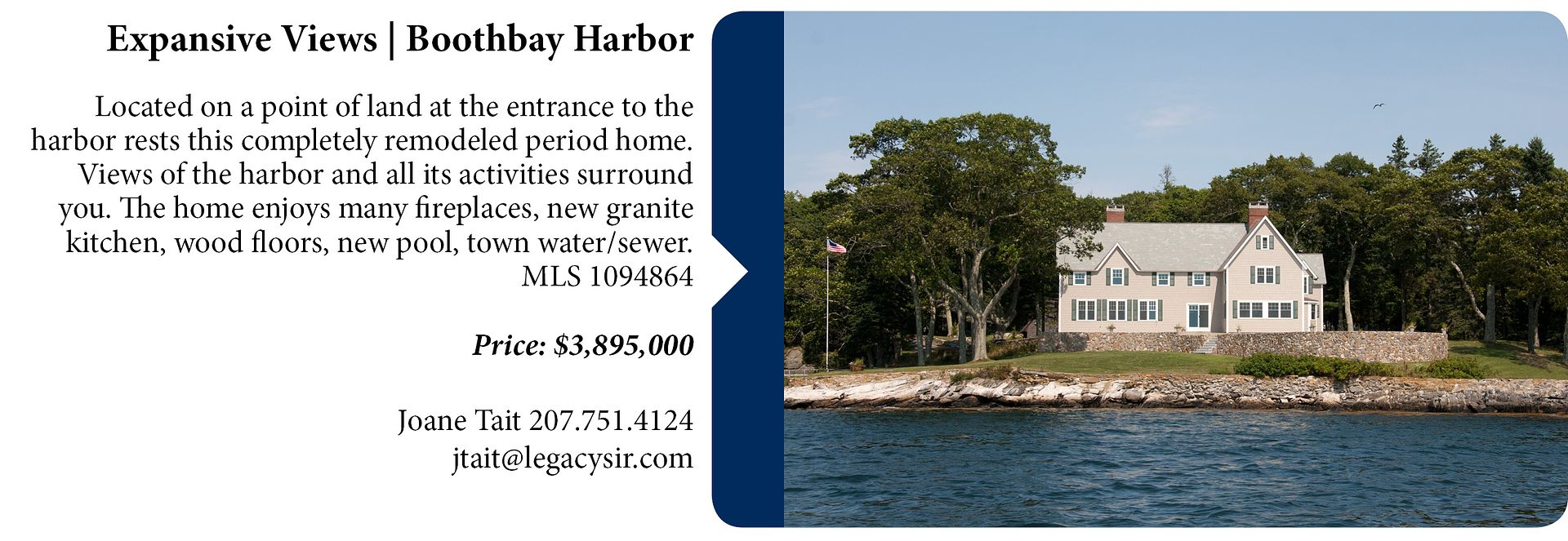

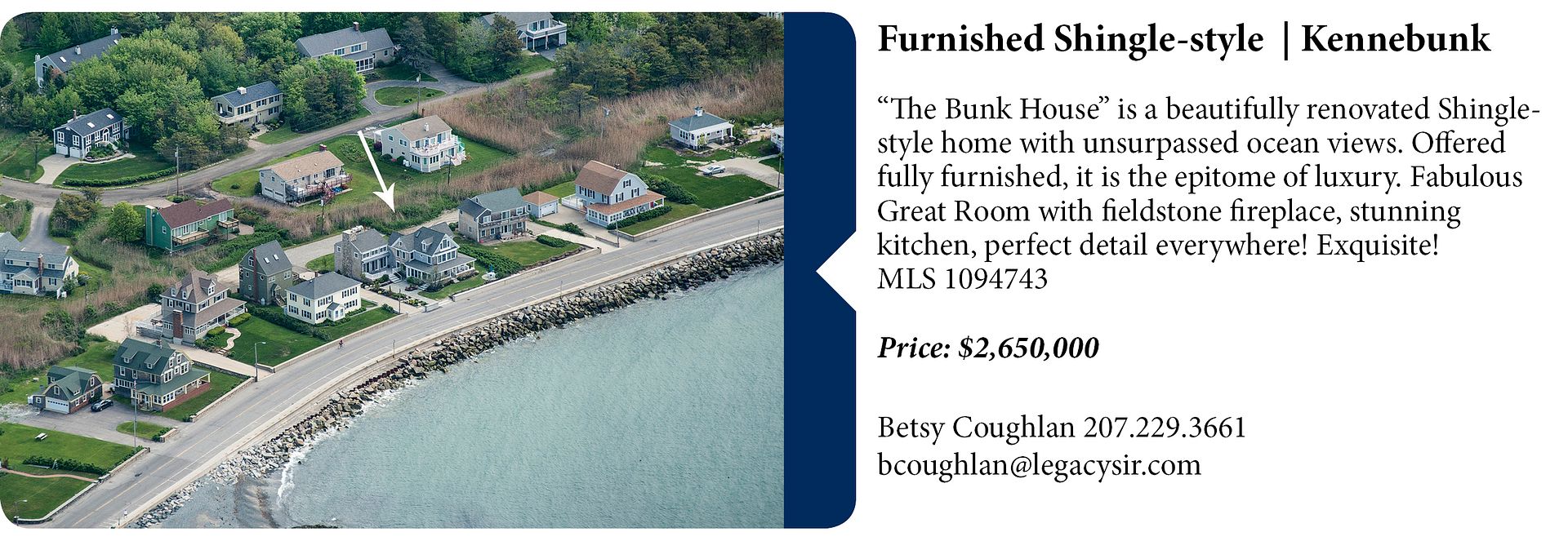

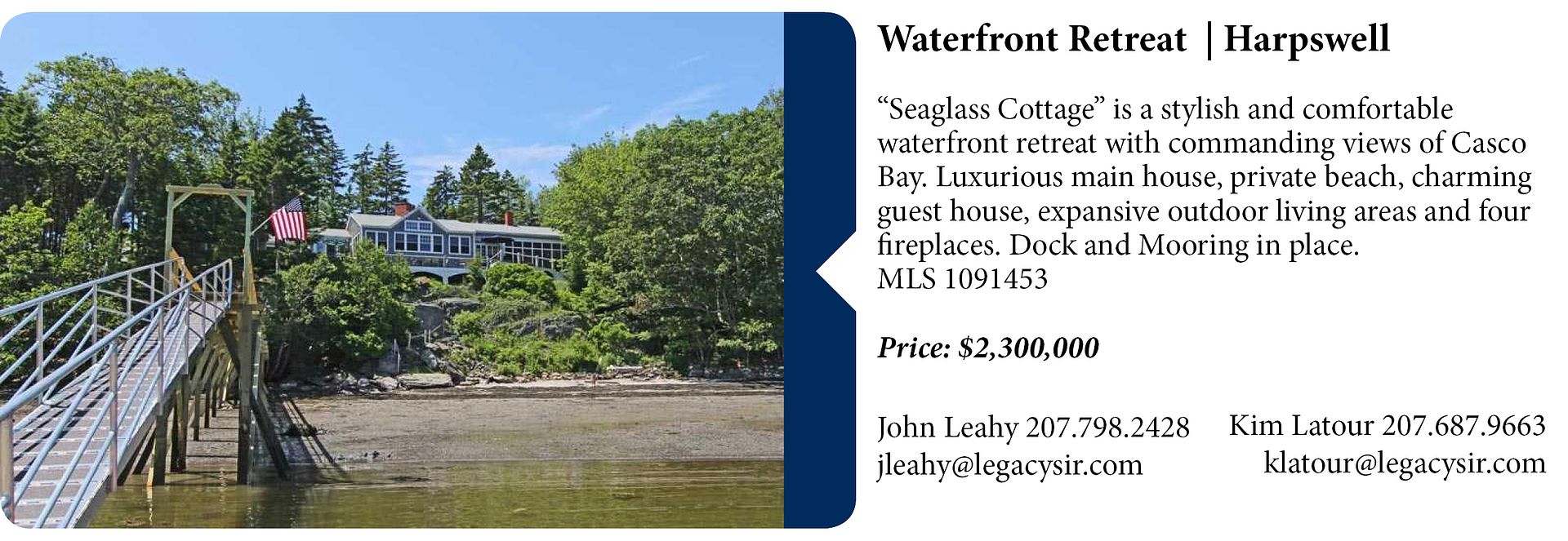

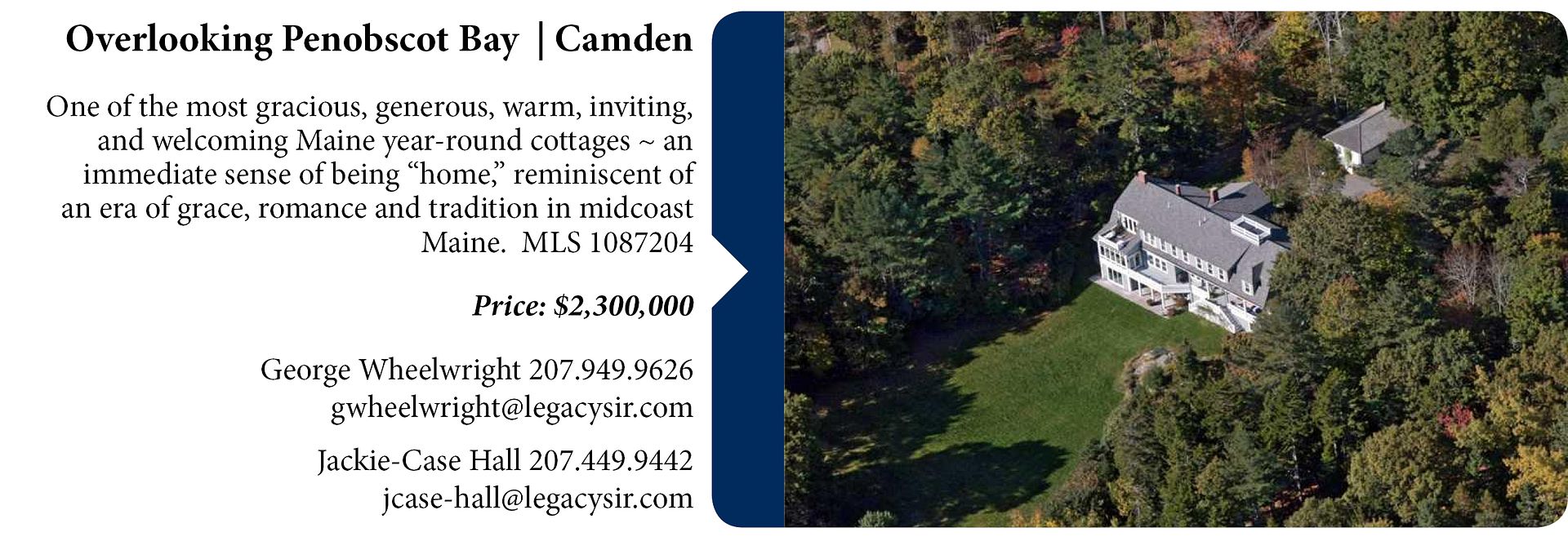

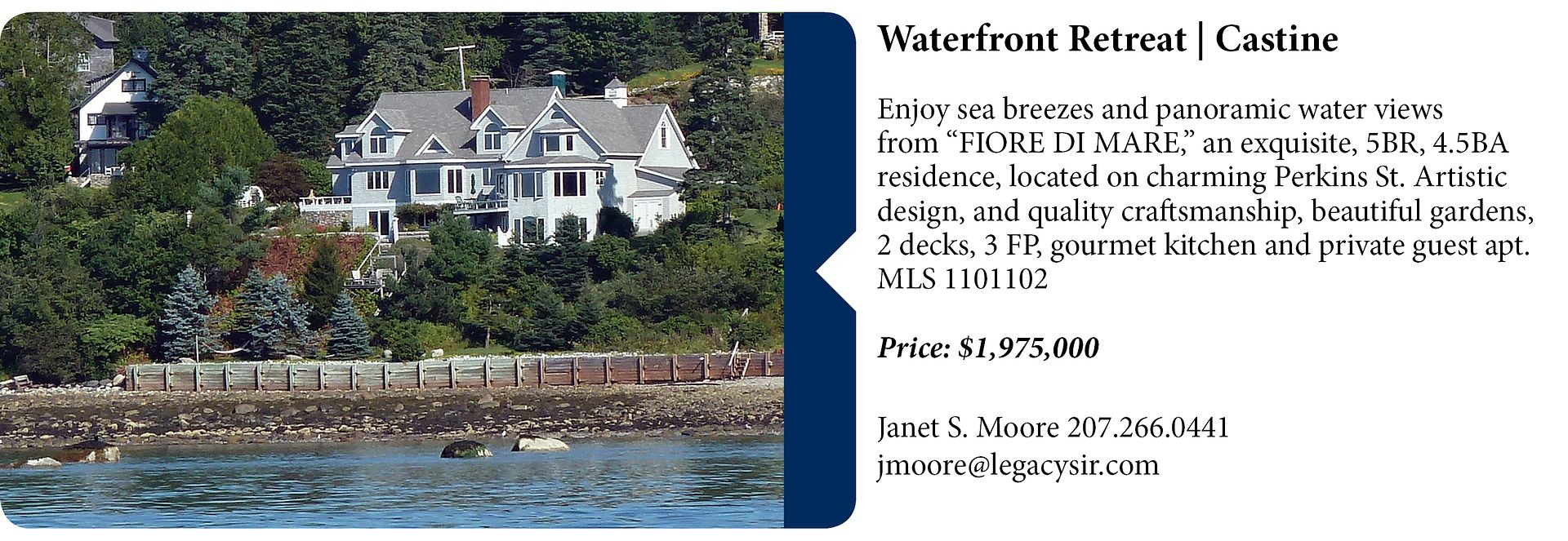

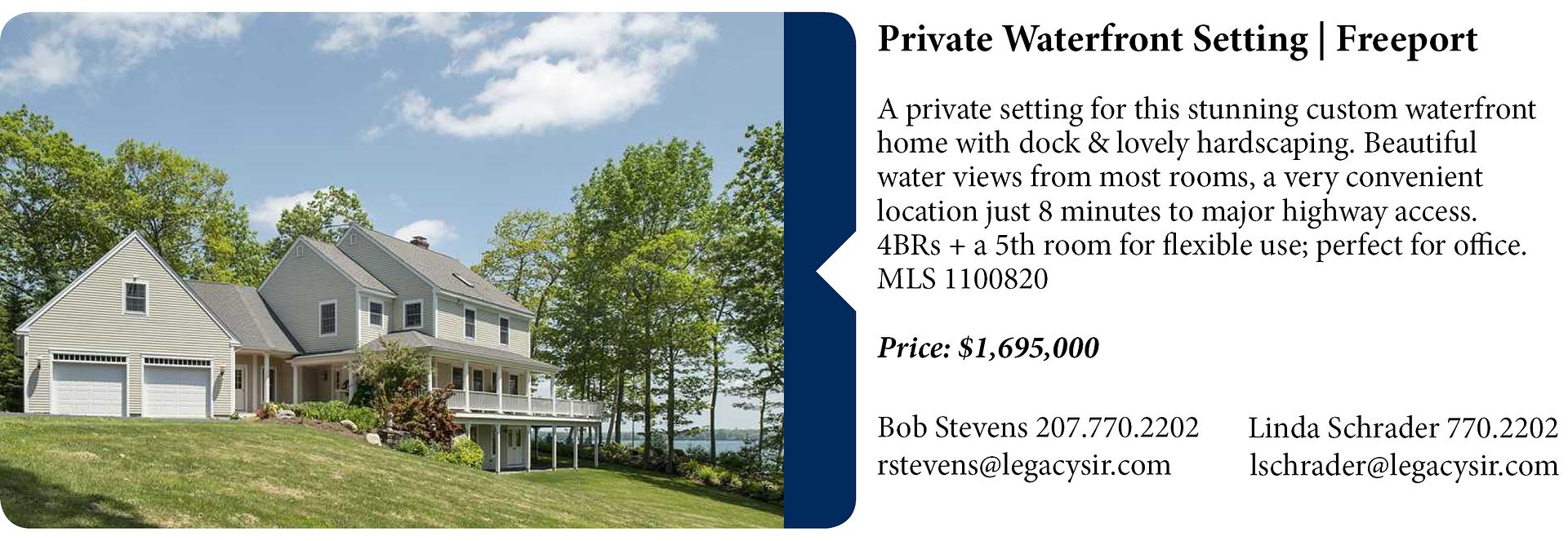

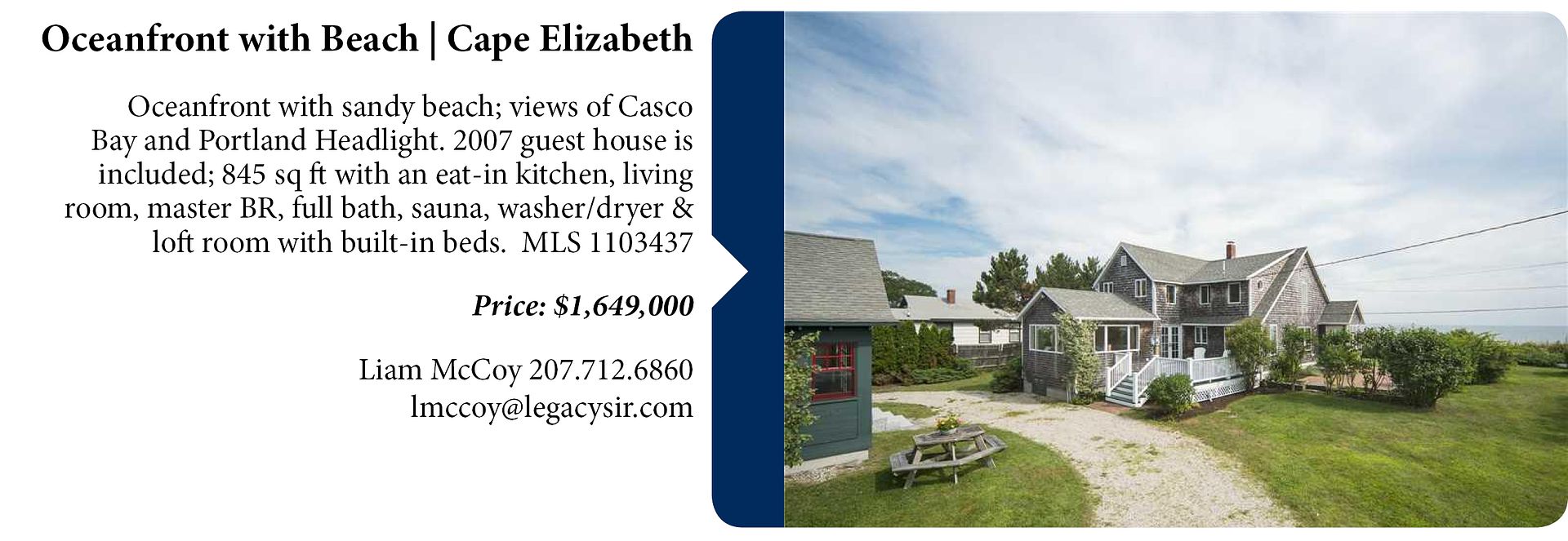

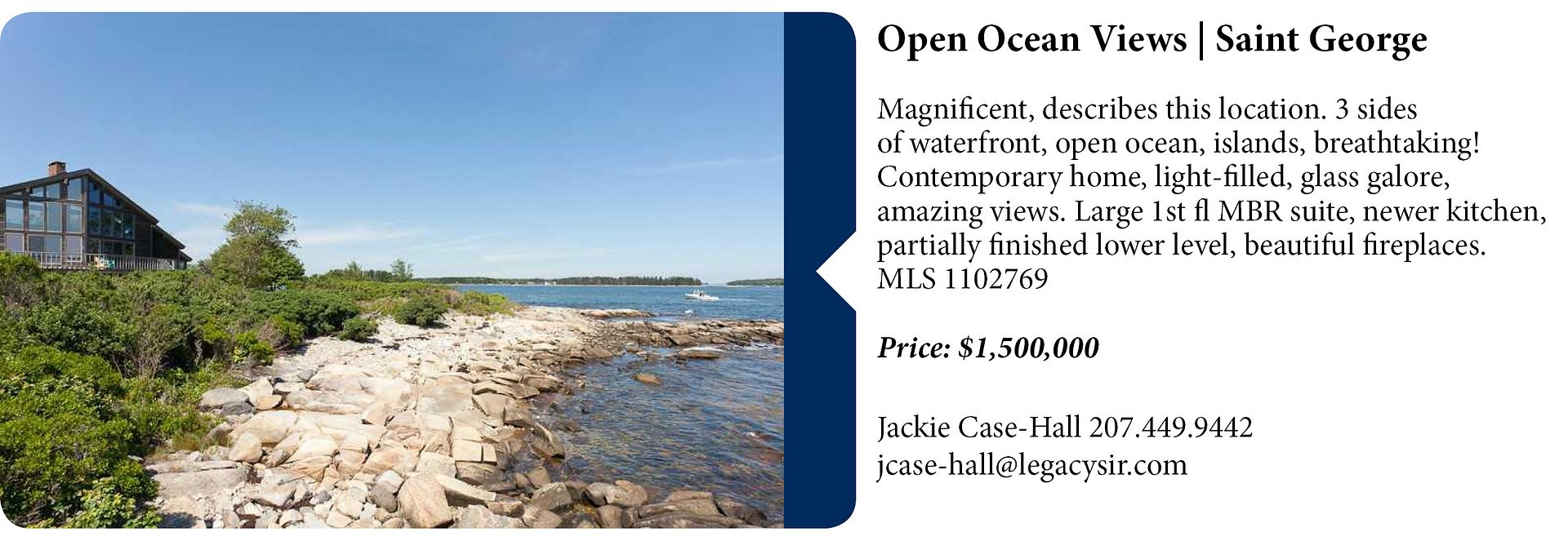

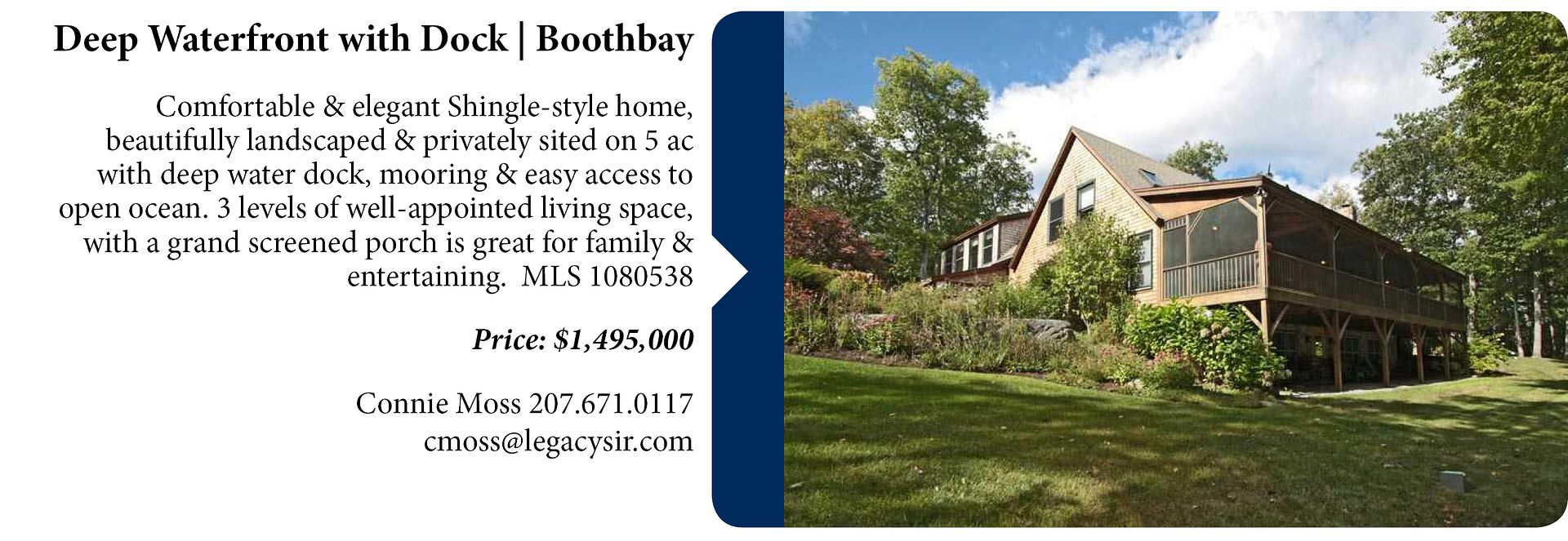

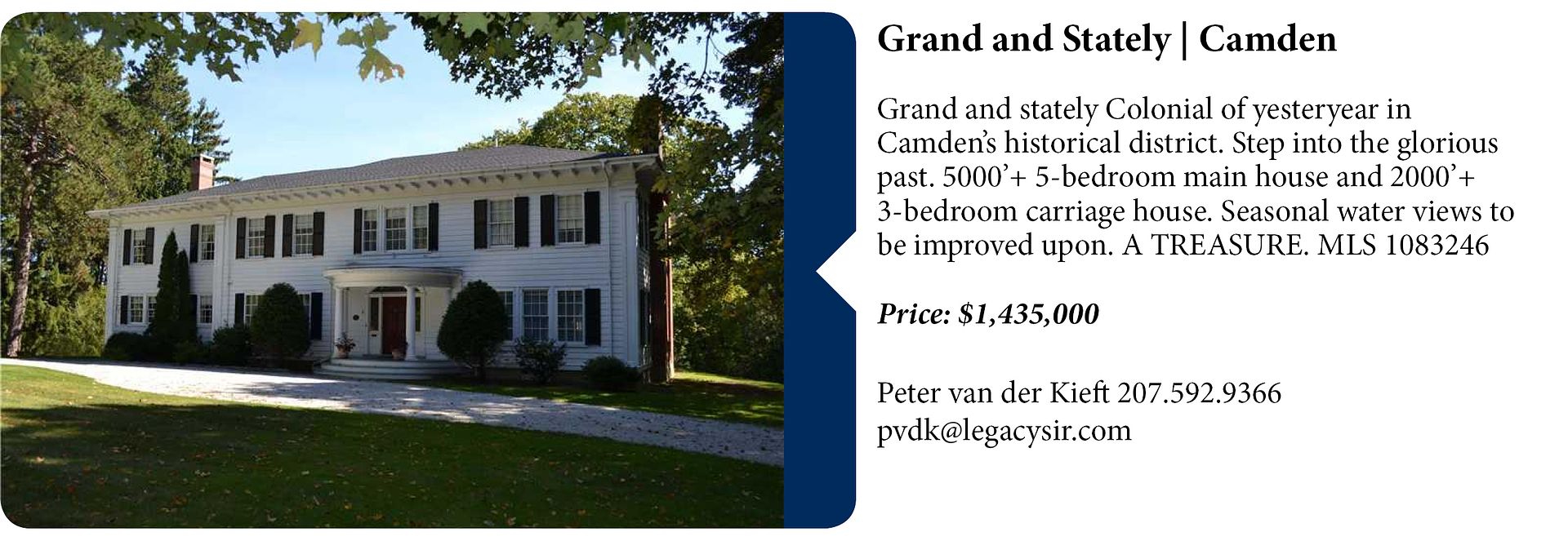

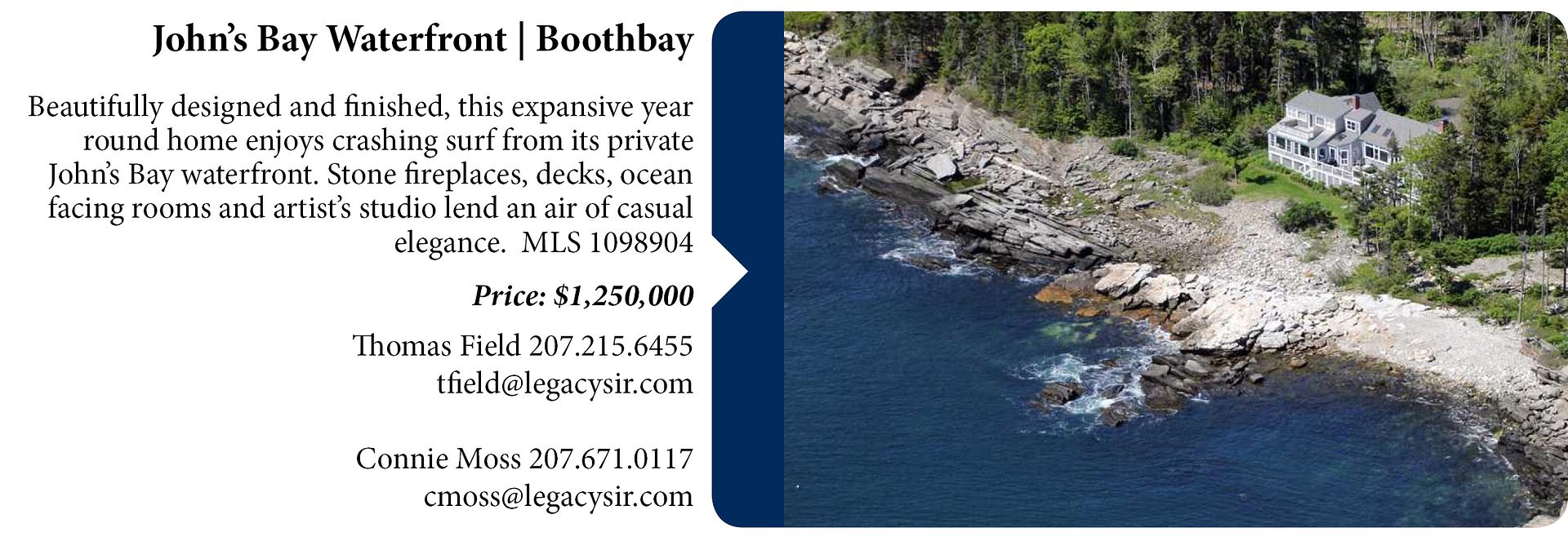

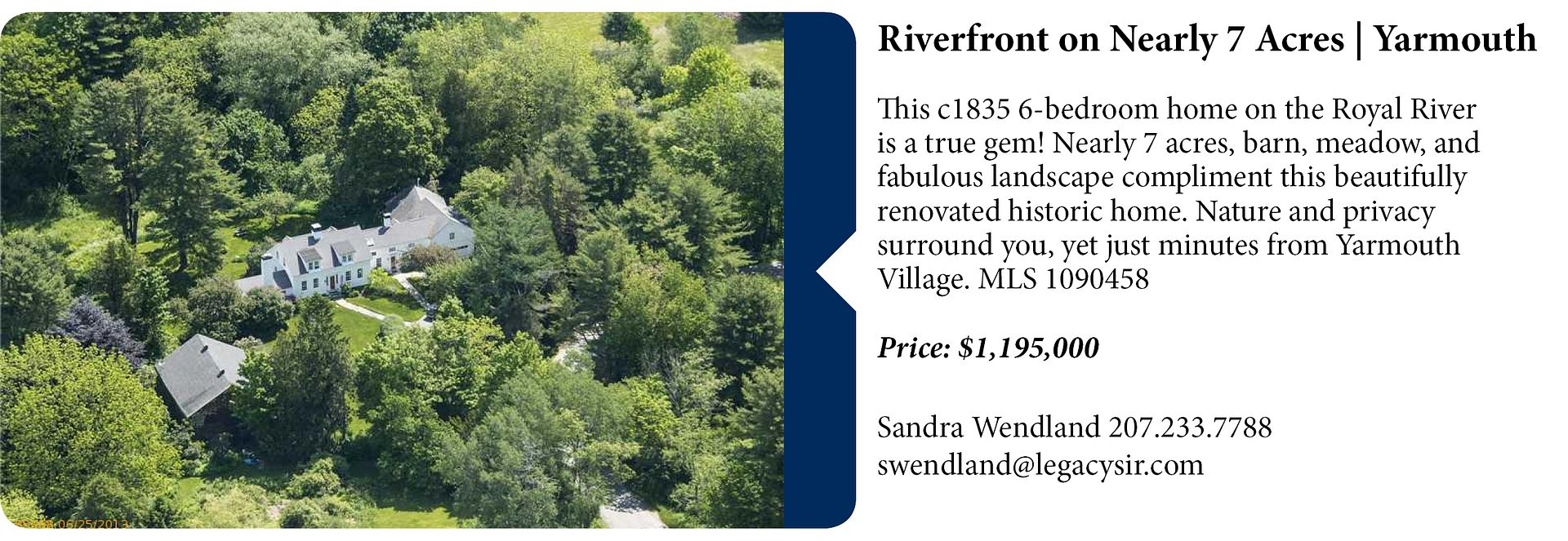

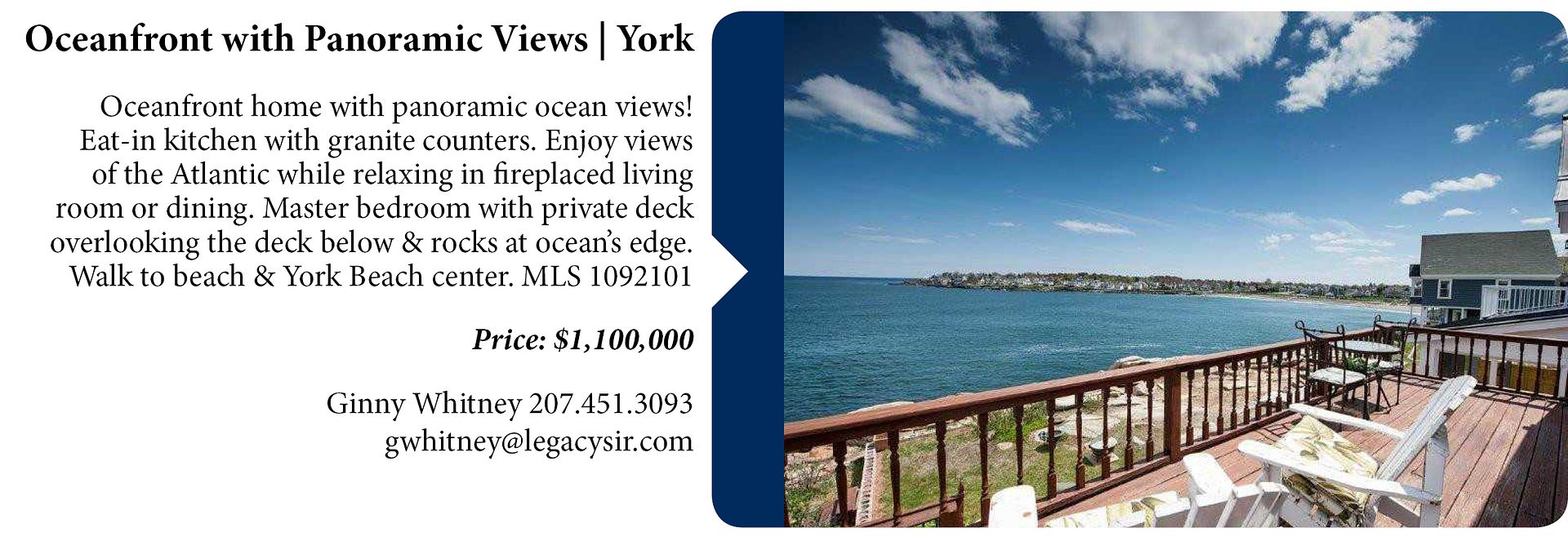

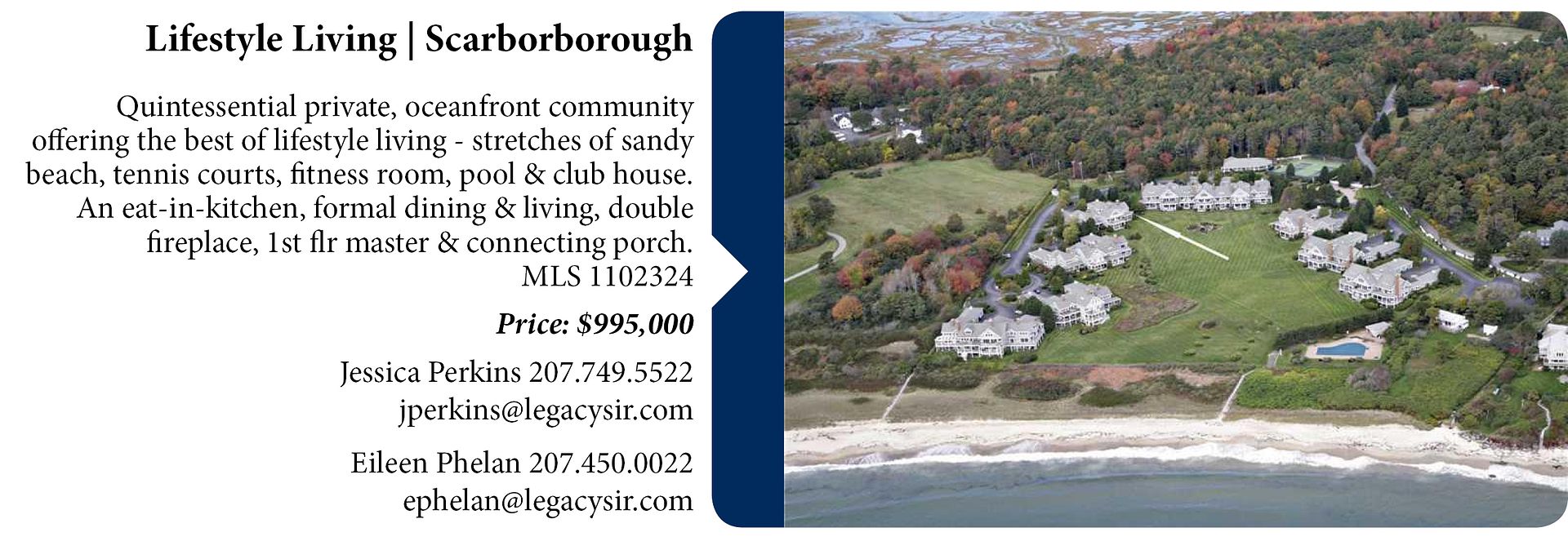

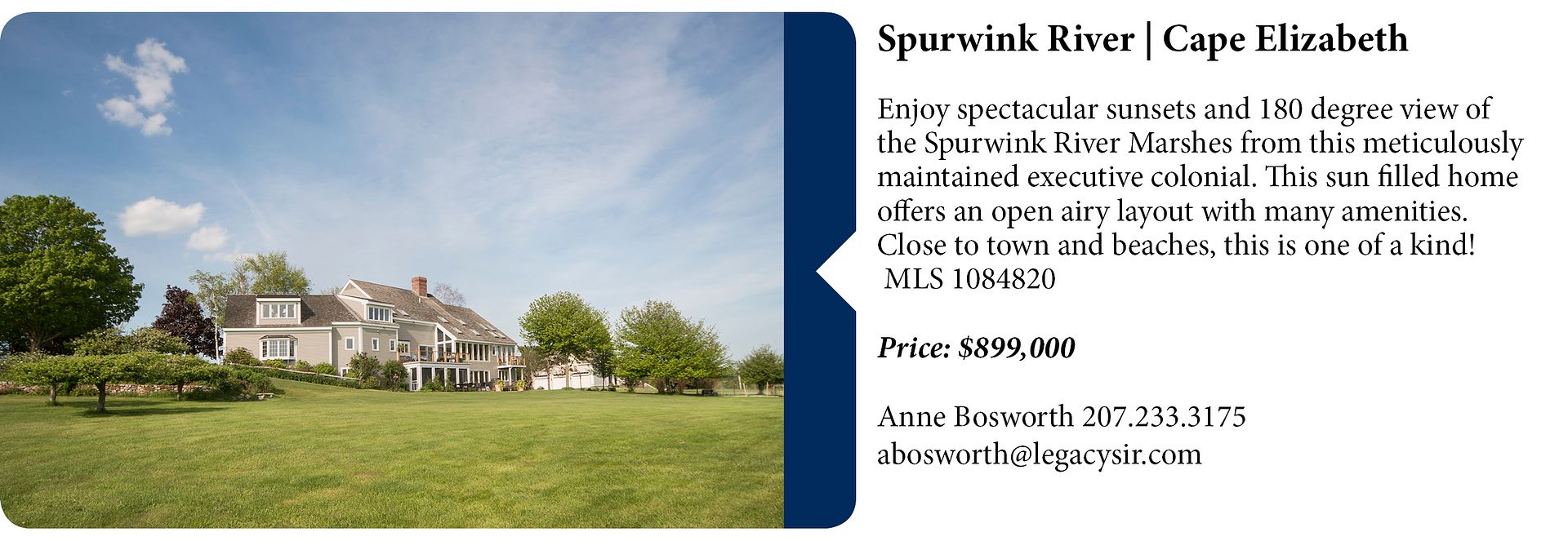

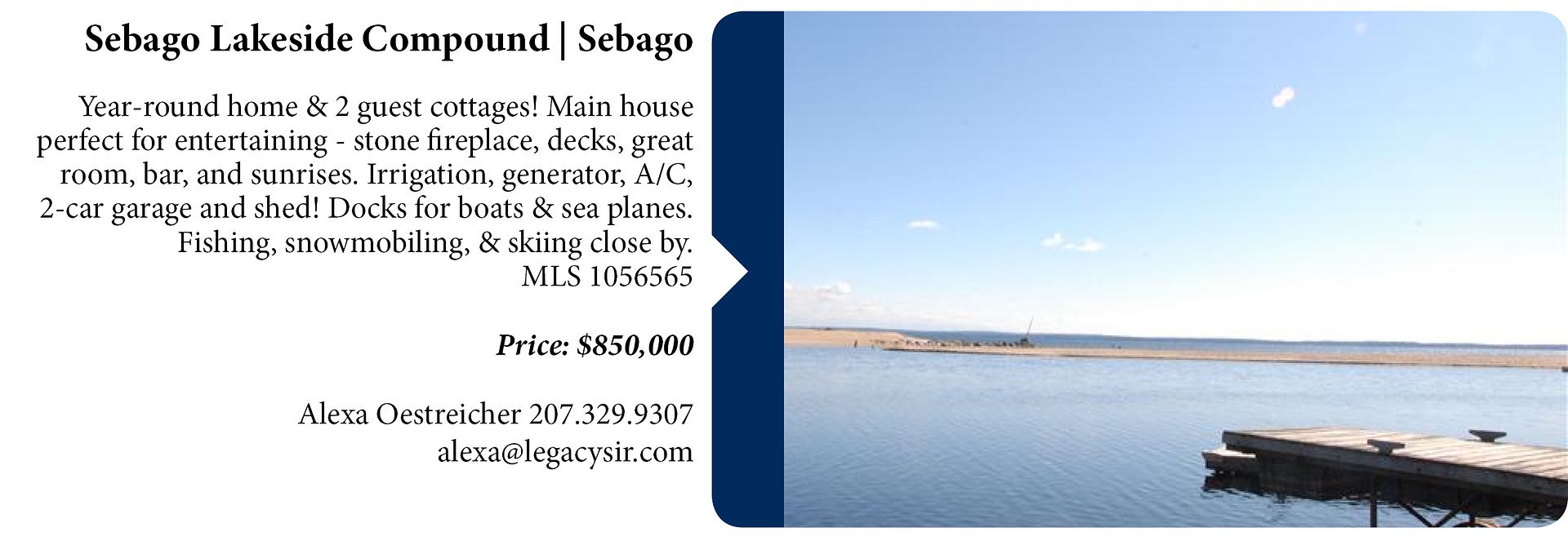

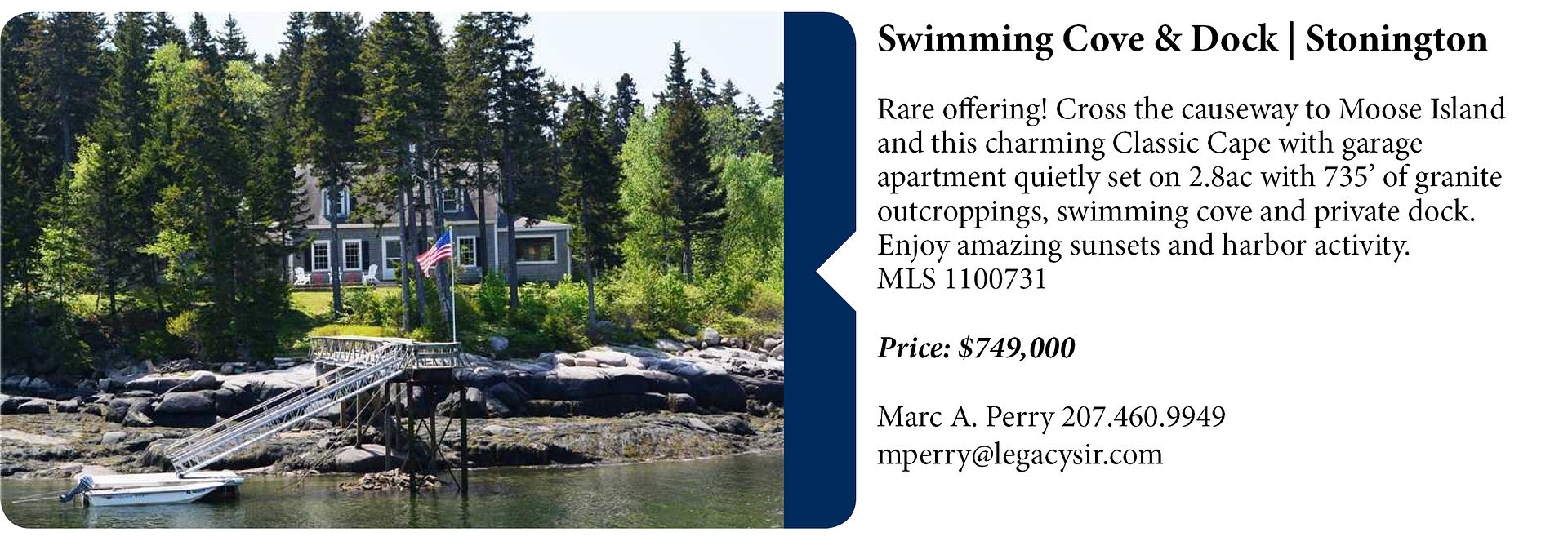

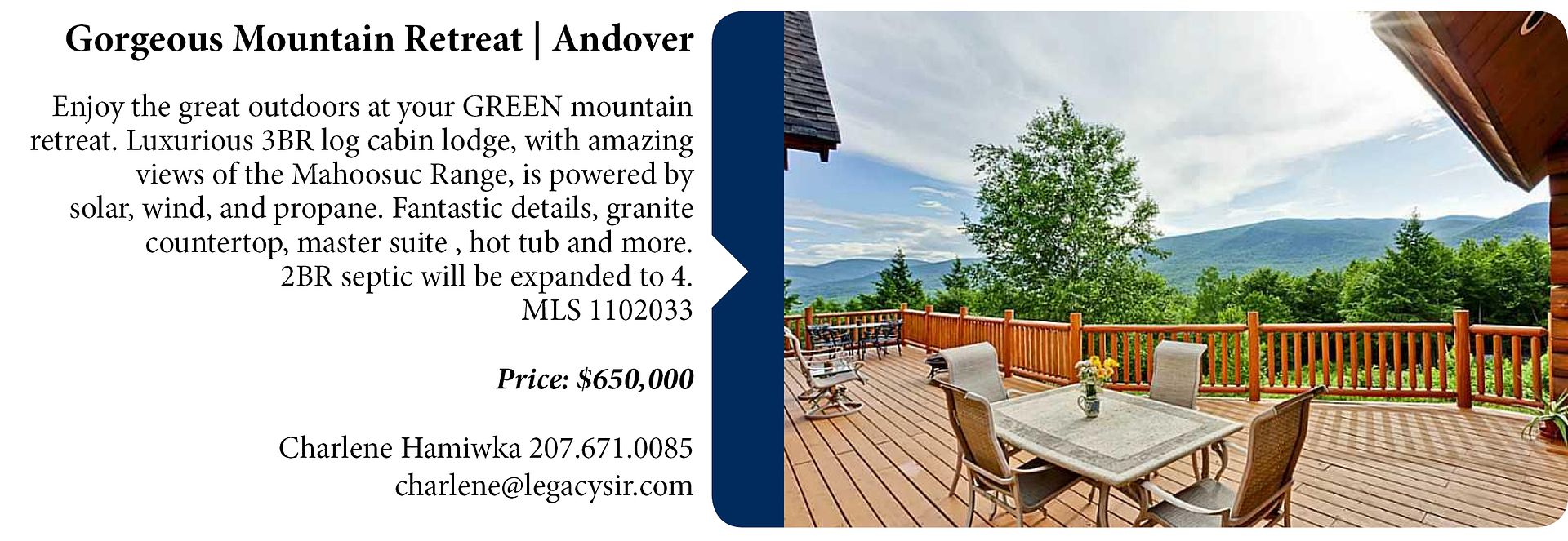

F E A T U R E D C U R R E N T L I S T I N G S

Click on the office name to view all the listings for each office.

Kennebunk | Portland | Brunswick | Damariscotta | Camden

Unless otherwise specified, all Maine real estate statistics were compiled using Maine Listings data. There is no guarantee of the accuracy and completeness of the data.